Top 2 Tampines Money Lenders. Lowest Rates, Licensed & Reputable.

At SG Top Choice, we compare multiple companies and recommend the best. So you don’t have to. We have compiled a list of the Top 2 best recommended Tampines Money Lenders in Singapore. No need to sieve through multiple websites, we have done the work.

We have ensured that they are licensed money lenders with a good reputation. No need to travel too far out. Tampines has its fair share of money lenders, and here are the top 2 recommended money lenders in Tampines!

Fast Money Pte Ltd

License Number: 133/2021

Top Tampines Money Lender for:

Easy and Flexible Loans. Competitive rates and Fast approval times.

| Contact | Address |

|---|---|

| Submit Enquiry Here | Blk 505 Tampines Central 1 #01-341 Singapore 520505 |

Do you need help with business loans, personal loans, wedding loans, fast cash loans, or foreigner loans? Fast Money Pte Ltd is one of our top 3 recommended licensed money lenders in Tampines. You can be sure to expect quick response times, simple procedures, and flexible loan packages that are tailored to meet your every requirement.

Customer Reviews:

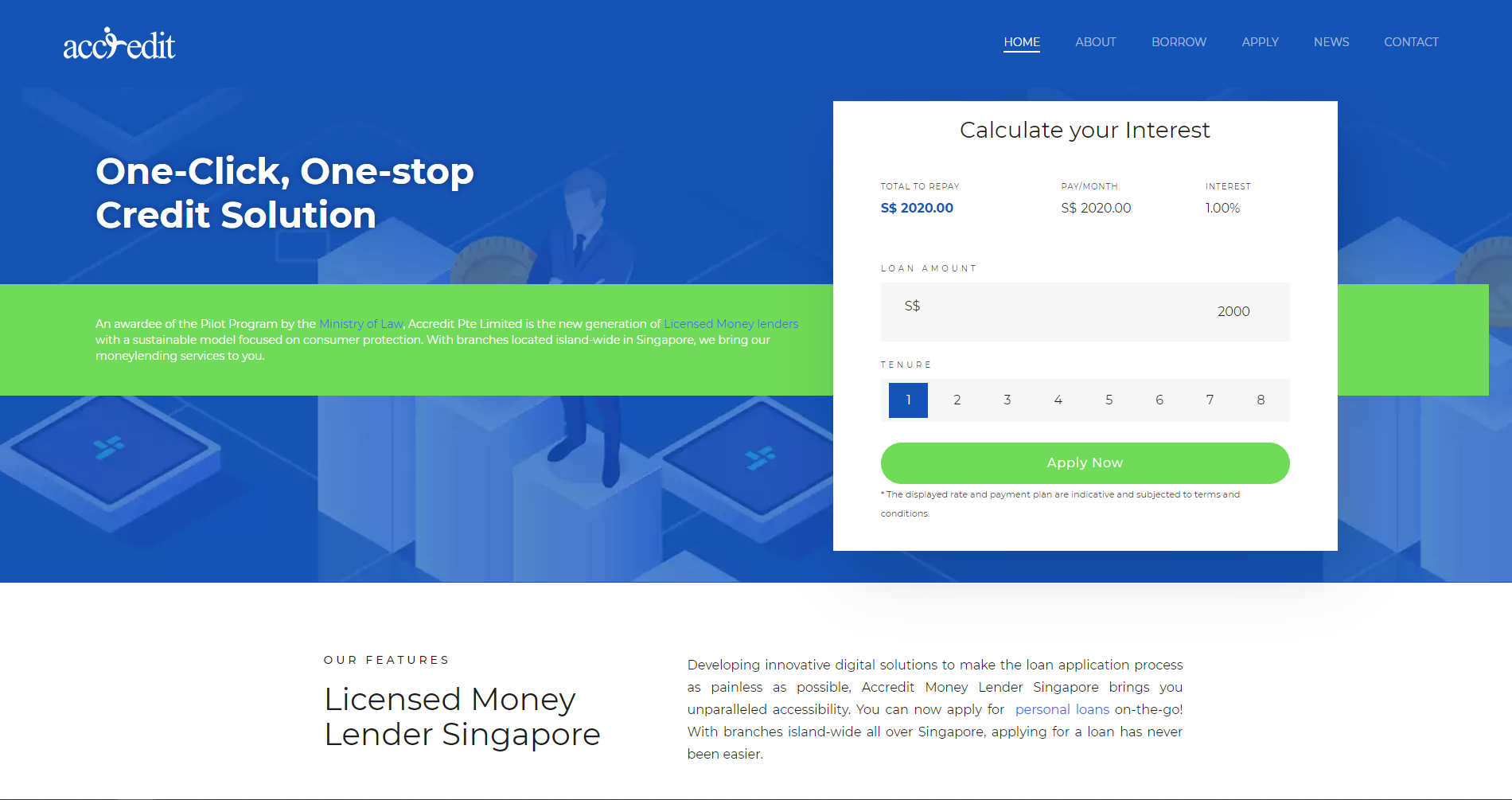

Accredit Pte Ltd

License Number: 72/2021

Top Tampines Money Lender for:

Accessibility all over singapore, secure transactions, easy applications.

| Contact | Address |

|---|---|

| Submit Enquiry Here | 503 Tampines Central 1 #01-315 SINGAPORE 520503 |

Accredit Pte Limited is an awardee of the Pilot Program by the Ministry of Law. They are proud to be reliable, licensed money lenders with a sustainable model focused on consumer protection. With branches located island-wide in Singapore, loaning money has never been more convenient! It is basically money lending services at your doorstep.

Customer Reviews:

5 important questions you must ask your money lender

The above money lending companies listed are certified, licensed money lenders regulated by the Registry of Money Lenders in Singapore. Thus, you have no need to worry if you will be scammed of your money. But you should still ask the following questions to empower yourself with knowledge of what you are getting yourself into.

- What is the interest rate on the loan?

- How does the loan prepayment work?

- What is the term of the loan?

- Are there any additional fees?

- Does the loan require a cosigner?